As the promise of tax refunds brings thoughts of vacations or home renovations closer to reality, it’s crucial to navigate through tax season safely first. Whether you’re in charge of filing tax returns for clients, managing the finances of a business, or simply an individual taxpayer crossing your fingers for a correct filing, the period leading up to April 15 can be anything but relaxing. The spring air should be a breath of fresh relief, not a harbinger of anxiety over potential IRS scams.

Stay Vigilant

According to the Federal Trade Commission, in 2023, taxpayers lost $4.26 million in IRS imposter scams.

As our interactions increasingly migrate online, distinguishing between safe and risky information sharing has become a blur. The convenience of digital notifications from banks and other institutions has unwittingly lowered our guard, making us prime targets for scammers during tax season.

“Scammers are coming up with new ways all the time to try to steal information from taxpayers,” said IRS Commissioner Danny Werfel.

People should be wary and avoid sharing sensitive personal data over the phone, email or social media to avoid getting caught up in these scams. And people should always remember to be wary if a tax deal sounds too good to be true.

Danny Werfel

Ways the IRS Will Contact You

It’s important to know that the IRS will never email you. They also will never text you or reach out to you through social media. You don’t have to worry about the police busting down your door. If there is a situation where the IRS needs to contact you, they will do it through mail first. The IRS could potentially call or come to a home or business. However, you will generally receive several notices and letters from the IRS in the mail beforehand.

If the IRS needs to conduct an audit it will be done either by mail or an in-person interview. This would either be at an official IRS office, at the taxpayer’s place of business, or at an accountant’s office.

In the event the IRS needs to make a collection they will contact you through an appointment letter to schedule a face-to-face meeting at a specific place and time. It will provide a phone number for you to call and confirm the appointment.

If an IRS employee comes to your home or business, they will have several forms of identification. Both forms of identification have serial numbers and photos of the employee – and you can ask to see both. When at a home or place of business, the revenue officer can also provide an additional method to verify their identification upon request.

According to the IRS website:

The IRS doesn't initiate contact with taxpayers by email, text messages or social media channels to request personal or financial information.

The Top IRS Scams You Need to Watch For

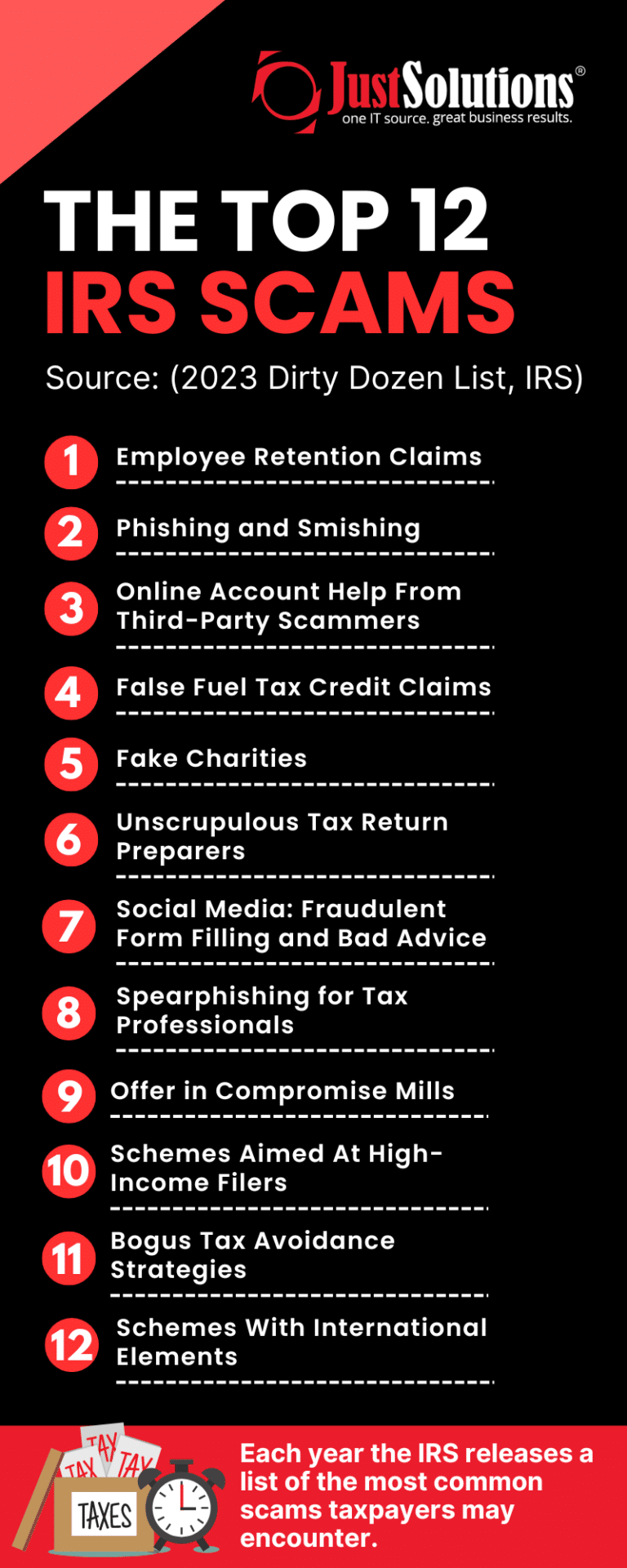

Each year the IRS releases a list of the most common scams taxpayers may encounter. These range from fraudulent calls, malicious emails or texts, fake charities, or other schemes. In most cases, the goal is to steal your money or your information.

A scammer will:

- Impersonate the IRS to intimidate and bully people into paying a fabricated tax bill

- Demand you pay taxes immediately without the opportunity to question or appeal the amount owed

- Use phone calls, letters, emails, social media and texts

- Threaten to arrest or deport victims if they don’t comply

Be particularly wary of phishing and smishing attempts, as these are common methods used to solicit personal and financial details under the guise of IRS communication.

Phishing and Smishing Tax Scams

As we have discussed earlier, the IRS will never send you a text message or an email regarding a bill or tax refund. If you see anything related in your inbox, you should be suspicious. These fake communications are tactics of phishing and smishing.

Phishing attacks are emails that seem legitimate but usually urge you to take action that will result in you leaking sensitive data or clicking a malicious link that will result in malware. If you’re not sure how to spot a phishing email, read our previous blog.

Smishing attacks are similar, but these come in the form of text messages. They usually come from an unknown number or an odd email and will urge you to click a link or reply.

Both tactics intend to lure you to provide personal and financial information that can lead to identity theft. Some of these communications may be regarding:

- An unpaid balance

- The need to update your taxpayer info

- A refund you need to collect

- An offer of help setting up and IRS account or gaining tax credits

Spearphishing and Cybersecurity for Tax Professionals

Spearphishing is a form of cyberattack that involves sending fraudulent emails to specific individuals within an organization or business. These emails are carefully crafted to appear legitimate, often using personal information or details specific to the target to make them more convincing. Tax professionals need to be aware of these scams. If successful, both client data and the tax preparer’s identity could be stolen. This would also allow the thief to file fraudulent returns.

In summary, if you get a text message or email from the “IRS” or “state,” think twice before you respond or click anything. Better yet don’t.

How To Report an IRS Scam

Encountering or suspecting an IRS scam should prompt immediate action. Report phishing attempts to phishing@irs.gov and financial losses to the Treasury Inspector General Administration (TIGTA) and the Federal Trade Commission.

For reporting abusive tax schemes or preparers, the IRS provides detailed guidelines on their website.

Make Cybersecurity A Priority All Year Long

Facing the reality that these scams will continue; personal and professional cybersecurity is non-negotiable. Just Solutions has a strong track record of aiding tax professionals and accounting firms in implementing effective cybersecurity strategies, ensuring data protection is a priority throughout the year. Whether you’re a business or an individual, don’t hesitate to reach out if you have any other cybersecurity concerns.